Recently, there’s been no shortage of bad news dominating international headlines. However, this is not likely to abate any time soon.

We have heard words like inflation, stagnation, and recession over and over. Suddenly, it looked like the global financial crisis from 2007-2009 would bite us in the backside. It has morphed into a new beast, one we are unfamiliar with when we look closer. As a result of this new reality, even optimists are looking at the post-pandemic world with bleak eyes.

Despite all the uncertainties, one thing seems certain. Global economic growth will take a long time to recover to pre-pandemic levels. In fact, both the World Bank and the OECD have cut their forecasts for global GDP growth. The World Bank specifically warned about the risk of stagflation, which means years of high inflation with low economic growth.

It is widely believed that the Ukrainian war, as well as COVID19, has contributed to inflation. The pandemic has disrupted the global supply chain. In addition, the war in Ukraine has exacerbated the problem. Ukraine is home to producing 18% of global barley exports, 16% of corn, and 12% of wheat. Also, according to BBC reports, around 50% of the world’s supply of neon gas, a key ingredient in making microchips, is sourced from Ukraine.

Global central banks have raised interest rates in a bid to combat inflation. Is this too little and too late? Among all other countries, Ukraine has more than doubled its interest rate to 25%, making it the highest in Europe. Ukraine’s inflation rate – or cost of living – has risen to 17% and is expected to reach 20% this year. The inflation rate in Turkey hit a 24-year high of 73.5% in the year to May, while food prices increased by 92% over the same period.

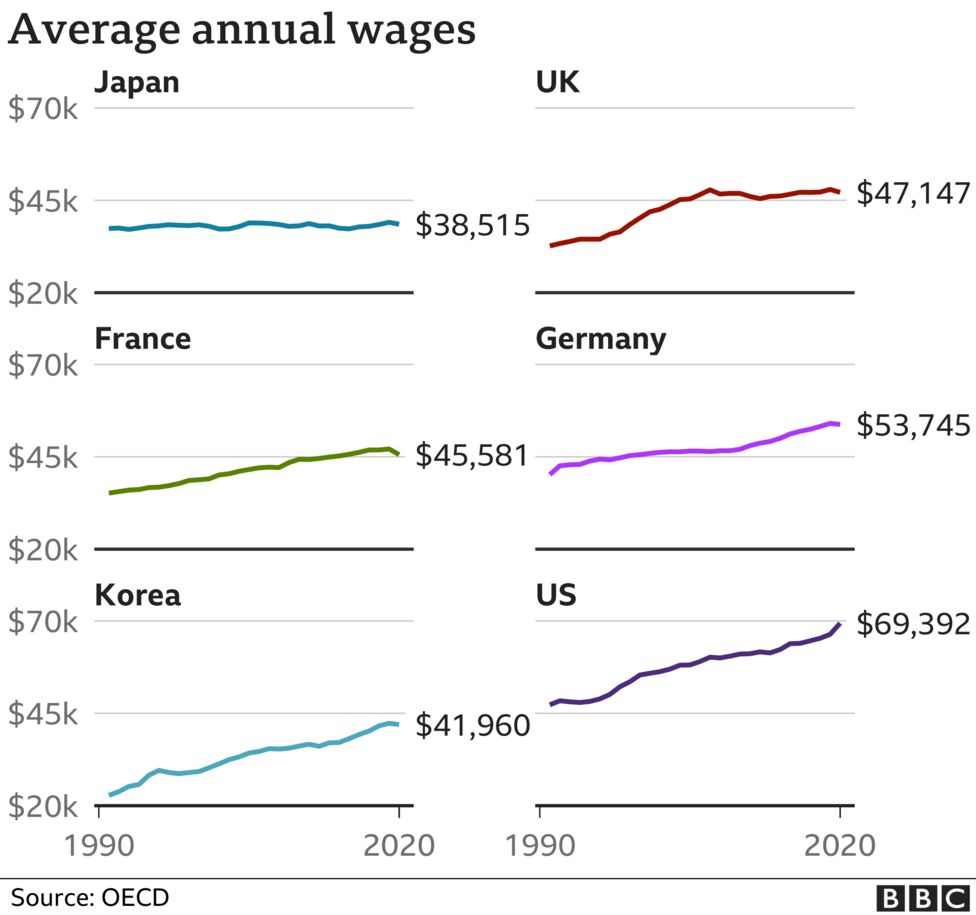

In Japan, the government has for years promoted inflation as a means of countering the economy’s recessive, downward spiral and to increase wages. Central bankers in the country now face unforeseen consequences. For one, the yen is weakening, and for another, prices and living costs are rising. Umaibo, Japan’s everyday snack, which has always been priced at 10 yen since it was created 43 years ago, went up by 20%, sending shockwaves through the nation.

As interest rates rise, global markets tremble. Specifically, the US stock market has plunged and has entered the bear zone. Year-to-date, the S&P 500 and Nasdaq 100 are down about 20% and 30%, respectively. US stocks still have a long way to fall, according to hedge-fund veteran Leon Cooperman, who predicts the economy will enter a recession in 2023.

Consumer confidence has been damaged by inflation expectations and low economic growth, combined with a squeeze on stock markets. In early June, the University of Michigan’s consumer sentiment index fell below forecasts, marking its lowest level since regular collection began in the 1970s. This has painted a bleak picture for the future of the economic recovery. Consumer spending counts for about 70% of economic activity in the US.